ZeroPhase

ZeroPhase is a European deeptech company developing sovereign, software-defined connectivity systems for unmanned platforms and critical operations. Its long-range, high-throughput data links are designed to deliver resilient, secure, and scalable communication, even in highly contested and demanding environments.

ZeroPhase enables reliable connectivity at scale by combining performance, trust, and software-defined flexibility. By building accessible and dependable communication systems, Zerophase is laying the foundation for the next generation of sovereign, interconnected networks.

Caracol AM

Caracol is a leading provider of large-format additive manufacturing solutions. Founded in 2015, the company has developed a proprietary 3D printing technology that enables the production of complex, lightweight components for industrial applications across sectors such as aerospace, energy, marine, and automotive. By combining advanced engineering with sustainable production methods, Caracol helps manufacturers overcome the limitations of traditional fabrication processes.

Proxima Fusion

Proxima Fusion is a European deeptech company developing the first generation of commercial fusion power plants. Spun out of the Max Planck Institute for Plasma Physics, Proxima leverages quasi-isodynamic stellarator technology, advanced simulations, and high-temperature superconducting magnets to turn decades of research into clean, reliable energy for the grid.

Proxima Fusion helps accelerate the transition to sustainable power by providing a path to safe, continuous, and carbon-free electricity at scale. By combining cutting-edge physics with industrial engineering, it transforms the challenge of fusion energy into a competitive advantage for global energy systems.

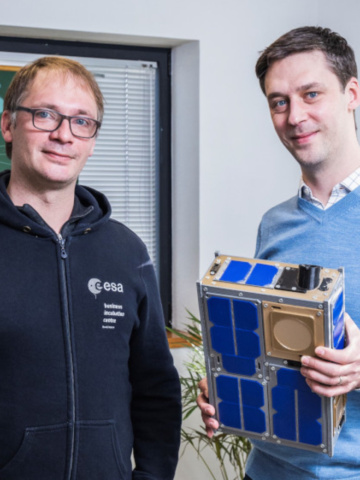

Skynopy

Skynopy is a fast-growing NewSpace company that provides satellite operators with on-demand, turnkey ground connectivity services. For the first time, with Skynopy, operators can access a global antenna network through a single software platform, without heavy capital investment, while optimizing performance, coverage, and cost.

Skynopy helps satellite operators increase data throughput, reduce revisit times, and operate with greater agility. By combining its own infrastructure with partner ground stations and virtualized modems, Skynopy transforms ground segment complexity into a seamless service, enabling customers to focus on their missions while gaining a competitive edge in a rapidly evolving space industry.

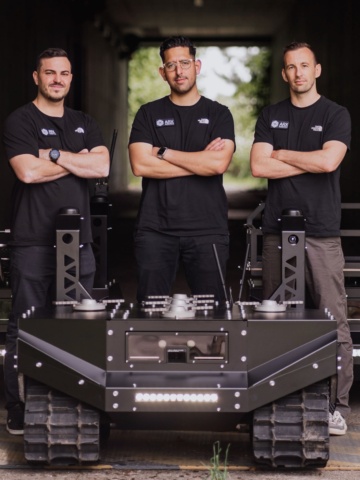

ARX Robotics

ARX Robotics focuses on the digital transformation of land forces and the development of autonomous unmanned systems. With the ARX Robotic Framework, an innovative approach combining software-enabled hardware and modular platform structure, ARX leverages the transformative potential of robotics and artificial intelligence to reshape the capabilities and capacities for land forces. Furthermore, ARX Robotics uses its operating system, MITHRA OS, to digitally transform and modernize existing vehicle fleets. Mithra OS enables legacy vehicles to be turned into intelligent, connected units by integrating AI, sensor systems, and software-defined autonomy.

Carbyon

Carbyon's direct air capture (DAC) uses an innovative patented technology to capture CO2 directly from the atmosphere. This ‘fast swing’ technology increases CO2 capacity and ensures rapid operation speed, thereby significantly driving down unit, energy, and project costs – all critical criteria to facilitate large-scale deployment.

Proxima Fusion helps accelerate the transition to sustainable power by providing a path to safe, continuous, and carbon-free electricity at scale. By combining cutting-edge physics with industrial engineering, it transforms the challenge of fusion energy into a competitive advantage for global energy systems.

CBA

CBA Informatique Libérale is a French company founded in 1986 that specializes in software and digital solutions for healthcare professionals, particularly independent nurses (IDELs). Their focus is on streamlining administrative tasks (billing, accounting, teletransmission, etc.) that can take nurses away from patient care. With over 30,000 satisfied customers, CBA Informatique Libérale has become a leading provider of software solutions for independent nurses in France.

Erneuerbare Energien Fabrik

Erneuerbare Energien Fabrik (EEF) is a German onshore wind and solar PV developer. Leveraging on the founding team's extensive experience and network, EEF is providing holistic solutions to local stakeholders, combining wind, photovoltaics and storage.

OmnION

Arrow Global

Arrow is a fund management business currently managing over €8 billion in funds under management including its core flagship fund, Arrow Credit Opportunities II (ACO II), a €2.75 billion fund closed in 2023. In addition, Arrow operates a network of asset management platforms in its five key markets (Italy, Portugal, UK, Ireland and the Netherlands) which also acts as an origination platform to source investment opportunities in secured and unsecured assets and generate differentiated returns on its fund investments.

Aventim

Based in Northern France, Aventim develops offices and residential assets and is committed to supporting urban renewal and the ecological transition of the built environment. Aventim carries out its projects with low environmental impact to adapt the city to the challenges of tomorrow. It takes into account environmental and social issues for every project.

Enray Power

Enray Power (formerly Integrum) is a UK-based developer of utility-scale renewable energy projects focusing primarily on photovoltaic, battery energy storage and co-located hybrid projects.

Faria Renewables

Faria Renewables is a Greek solar PV and wind developer. It has a dual strategy, developing its organic pipeline of projects, while also maintaining an opportunistic approach to M&A opportunities. It is positionning itself to lead in the country's fast-growing market.

Enova Value II

Enova Value II is a joint venture between Omnes and Enova, a pioneering wind project developer in Germany. The ambition of the partnership is to acquire operational wind projects and repower them; redeveloping the site and replacing existing projects with the latest technology.

Quantum Systems

Quantum Systems specializes in the development, design, and production of small Unmanned Aerial Systems (sUAS). The company’s range of electric vertical take-off and landing (eVTOL) sUAS are built to maximize range and versatility and provide operators with a seamless user experience. By integrating cutting-edge software capabilities like edge computing and real-time AI-powered data processing, Quantum Systems is building next-generation UAS for clients in defence, security, and the public sector. Quantum-Systems has business locations in Germany, the United States, Australia and Ukraine.

Jimmy Energy

Jimmy designs and operates small modular nuclear reactors to supply its customers with decarbonised heat at a lower cost than that obtained from fossil fuels. Jimmy’s thermal generators are based on high-temperature nuclear micro-reactors (HTRs) that create the desired heat. These reactors are well-known, very hot and very safe.

Jimmy was created in 2020 on the basis of two observations: On the one hand, manufacturers need to change their source of heat, but there are few profitable low-carbon alternatives. On the other hand, nuclear fission makes it possible to produce low-carbon heat at low cost. Jimmy’s objective is to move as quickly as possible towards decarbonisation. After a concept maturation phase in 2021, Jimmy is now relying on a determined multidisciplinary team to reinvent the use of fission to decarbonise the industry. Their aim is to get his industrial demonstrator up and running by 2026, to make his vision of a low-carbon, competitive industry in France a reality.

Planet A Foods

Planet A Foods is the leading next-generation ingredient champion delivering sustainable, nutritious ingredients to the food industry. The company, launched in 2021, uses innovative preparation processes and solely natural ingredients to develop sustainable, future-proofed products that are created independently of highly limited resources such as cocoa, palm oil or land. Its portfolio includes the world’s first cocoa-free chocolate, ChoViva, which is made from regional oats and sunflower seeds.

The Exploration Company

The Exploration Company’s mission is to democratize space exploration, making it affordable, available and sustainable. To realize this mission, The Exploration Company develops, manufactures and operates Nyx, a modular and reusable orbital vehicle that can eventually be refuelled in orbit and uses green propellants. The technical bricks of Nyx are built with open interfaces: they are available on a SpaceStore to enable space & non-space companies to use them and develop new applications. Nyx provides a wide scope of missions ranging from resupplying space stations around the Earth and the Moon, free flying around Earth or landing on the Moon – and safely coming back on Earth. Nyx starts with flying cargo and has the potential to carry humans in the long run.

DiogenX

DiogenX, is a preclinical stage biotech company specializing in the development of pancreatic beta-cell modulators for the treatment of type one diabetes (T1D).

DiogenX’ lead program is a potential first-in-class, disease-modifying recombinant protein designed to modulate the Wnt/β-catenin signalling pathway to regenerate pancreatic insulin-producing beta cells. To date, the company has achieved in vivo proof of concept demonstrating efficacy in prevention and reversion settings and an unprecedented effect on human beta cell mass generation, leading to increased functional insulin-producing beta cells. In addition, long term exposure to the drug was well tolerated in all preclinical models and showed the unique ability to safely modulate the Wnt/β-catenin pathway. This collective data suggests the potential for broad clinical utility, in monotherapy and in combination with insulins and therapies that replace or protect beta cells.

Avania

Avania is a global company that helps bring medical devices to market. The company specializes in working with medical technology firms throughout the entire development process, from initial design to post-approval. It offers a wide range of services including clinical trial management, regulatory consulting, and data analysis. Headquartered in the Netherlands, Avania operates eight offices across North America, Europe and Asia Pacific, supporting clients in bringing new medical products to patients safely and efficiently.

Ecovadis

Ecovadis is a sustainability ratings platform that assesses companies' environmental, social, and ethical practices. They analyze businesses based on four pillars: environment, labor and human rights, ethics, and sustainable procurement. With this evaluation, Ecovadis helps companies improve their sustainability performance and communicate their commitment to ethical practices to partners and investors.

Omniprom 2

Omniprom 2 is an investment vehicle bringing together Omnes, Promoval – a real estate developer, and Crédit Agricole Centre-est, via its subsidiary La Compagnie Foncière Lyonnaise. The purpose of this holding company is the acquisition of office buildings in prime location in Lyon and then their refurbishment into buildings with high energy and environmental performance.

Eclairion

Eclairion develops, owns and operates a unique digital infrastructure in France dedicated to hosting High Performance Computing servers within container modules with a total capacity of c. 60MW.

Turn

Turn Energy is a developer of PV projects in Sweden with the ambition to become the leading Swedish solar IPP.

CCE

CCE Holding is an Austria-based company established out of the merger of 2 solar PV project developers, CCE Group and Enernovum. With projects under development and construction in Italy, Germany, France, Romania, the Netherlands and Chile, CCE Holding targets to become a leading European PV IPP.

TagEnergy

TagEnergy is a fast-growing global IPP formed in 2019 to accelerate the energy transition by developing and investing in competitive and clean power stations (wind, solar and battery storage). Its operations span the renewables value chain, from development, financing, construction and asset management. TagEnergy has developed projects in the UK, Australia, Spain, Portugal and France.

OpenSee

Opensee is an award-winning fintech company that provides financial institutions with real-time big data analytics solutions. For the first time, with Opensee, financial institutions can leverage 100% of their stored data, virtually without size limitations, without compromising on performance, volume or cost.

Opensee helps financial institutions improve their business requirements, such as risk monitoring, trade execution quality management, and helps them respond more effectively to regulatory reporting while achieving cost and operational efficiencies. They help transform big data challenges into competitive advantages by bringing advanced analytics.

Qantev

Qantev is an artificial intelligence company that helps health insurers deliver better healthcare to their members. Powered by cutting edge machine learning and optimisation to predict patient journeys, Qantev can provide unprecedented insight and automation by leveraging insurers’ historical claim data.

Parima

PARIMA is a global leader in next-generation animal production, pioneering a more sustainable and efficient way to create high-quality animal products through innovation. Formed from the combination of Gourmey and Vital Meat, the company builds on deep expertise in cell cultivation, bioprocessing, and food science. PARIMA develops real animal products directly from cells across multiple species, combining advanced technology with culinary excellence at its headquarters in France. PARIMA’s culinary brand, Gourmey, focuses on premium cultivated proteins developed in collaboration with leading Michelin-starred chefs worldwide.

Whitelab Genomics

The company was founded in 2019 by David Del Bourgo, a former engineer at General Electric Healthcare, and Julien Cottineau, a geneticist who trained at the Institut Imagine. Together, they have developed simulation software for the design of gene therapies. These consist of introducing genetic material into cells to treat a disease.

Qubit Pharmaceuticals

Qubit Pharmaceuticals was founded in 2020 with the vision of co-developing, with pharmaceutical and biotech companies, new, more effective and safer drugs. Its software takes full advantage of existing and emerging supercomputers to model quantum effects at the microscopic level with maximum accuracy. The multidisciplinary team and founders are based in France at the Paris Santé Cochin incubator and in the United States in Boston.

IKTOS

Iktos is an innovative company specializing in the development of artificial intelligence (AI) and robotics solutions applied to chemical research, more specifically medicinal chemistry and new drug design. The use of Iktos technology platform enables major productivity gains in upstream pharmaceutical R&D.

Iktos technology is built upon the latest developments in deep learning algorithms, for de novo design and AI-driven synthesis planning. Founded in 2016, it has a portfolio of 50 plus real world projects either completed or ongoing. Its customizable technology offers multiple proprietary algorithms to clients, including large/medium pharma, biotech companies and research institutes globally.

Unseenlabs

Created in 2015, Unseenlabs is an innovative company of French origin and a European leader in satellite RF geolocation of ships at sea. Its proprietary onboard satellite technology is capable of geolocating any vessel at sea, in near-real time, to within a kilometre, from a single nanosatellite. Unseenlabs supplies a wide range of maritime stakeholders with accurate, up-to-date data on vessel positions, providing better tracking of activities at sea.

UTAC CERAM Millbrook

UTAC CERAM is a French company that offers a full range of land vehicle services: regulation and homologation, testing and technical expertise (environment, safety, feasibility). Millbrook is a first-class provider of vehicle testing services and operates iconic pre-launch R&D proving grounds and test facilities. The two companies merged in 2021.

Geophoros

Geophoros is a vehicle dedicated to land conversion that will unite Bouygues Immobilier and Omnes. This vehicle finances the acquisition and conversion of industrial/commercial land until a building permit to develop residential programs has been obtained.The objective of this partnership is to “rebuild the city upon the city” in order to fight against land artificialisation, improve urban biodiversity and produce low-carbon housing.

Ortus Power Ressources Italy

Ortus Power Resources Italy, Srl, was formed in partnerhsip with Ortus Climate Mitigation, an international renewably energy developer. The company is developing a portfolio of onshore wind and PV in Italy. It has started to operate its first batch of PV projects as an IPP.

Quandela

Co-founded in 2017 by the doctor-researchers Pascale Senellart, Valérian Giesz and Niccolo Somaschi, Quandela is a French company that is among the world leaders in quantum photonics. Quandela is known for being the originator of Prometheus, the world’s first photonic qubit generator with broad application domains including quantum cryptography, quantum computing or quantum sensors. The company is developping a full stack quantum computer based on its photonic technology, available on the cloud.

Peoplespheres

Founded in 2015, PeopleSpheres is an innovative HR platform and 100 % open. This streamlined platform allows for managing all of your HR Saas software, in a unified and interconnected manner. It provides access to a marketplace that includes 18 publishing partners, with specific solutions covering all HR requirements from payroll to talent management. PeopleSpheres is a solution aimed at companies with 250 to 20,000 staff.

Elistair

Created in 2014 and based in Lyon (France), and Boston (USA), Elistair designs and manufactures tethered drone solutions for tactical surveillance and civil defense missions. Elistair’s products are used by armed forces, civil security services and a number of private companies, in more than 60 countries. Elistair was co-founded by Guilhem de Marliave and Timothée Penet, both of them alumni of the scientific graduate school Centrale Lyon.

Clario

LGC Group

LGC is a company that offers a full range of genomic analysis tools (reagents for DNA reactions), measurement tools (reference materials, laboratory testing) and supply chain quality assurance solutions. Its Genomics activity, which produces and distributes reagents and instruments for DNA reactions intended for pharmaceutical and industrial groups, notably produces the materials required to manufacture Covid-19 tests.

Mediawan and Leonine

Founded at the end of 2015 by Founded at the end of 2015 by Pierre-Antoine Capton, Xavier Niel and Matthieu Pigasse, Mediawan is one of the key independent European studios for audiovisual content. Since its formation, the company has completed many acquisitions including Leonine in 2020. Leonine is a platform created by the merger of several German production and distribution companies, backed by the fund KKR. Both companies are present in the production, distribution and licensing of audiovisual content. Mediawan is one of the key independent European studios for audiovisual content. Since its formation, the company has completed many acquisitions including Leonine in 2020. Leonine is a platform created by the merger of several German production and distribution companies, backed by the fund KKR. Both companies are present in the production, distribution and licensing of audiovisual content.

NAMSA

North American Science Associates (NAMSA) is an American medical-device focused CRO. NAMSA provides a full range of services: testing medical devices, regulatory advisory services and full continuum development solutions.

Olmix

Olmix is a company that offers algae-based solutions for animal and plant care, enabling the reduced use of antibiotics and chemical products. Founded in 1995, the company has developed a plan for agro-ecological transition and also markets trace elements intended for the animal feed, cement and vegetable industries.

PHM Group

PMH Group is a company created in 2020 through the merger of PHM and Kotikatu, two regional leaders in residential cleaning and maintenance in Finland and Sweden. The group provides maintenance services (indoor cleaning, grounds maintenance), technical services (electrical and automation services, water and heating system maintenance) and outdoor services (cleaning basements and courtyards, defrosting pipes).

TK Elevators (TKE)

TK Elevators (TKE) is in the production and maintenance of elevators and escalators division of the German industrial conglomerate Thyssenkrupp. TKE has a global presence with 17 production sites and more than 50,000 employees in Europe, America and Asia.

Redman

Redman is the leading independent low carbon property-developer in France, with a focus on mixed operations and urban transformation projects. Redman has an impressive track record on complex and iconic projects (station F, Le Monde's headquarter)

Centre Aquatique Olympique

Omnes, Bouygues Bâtiment Ile-de-France and récréa have signed, alongside the Greater Paris authority, a 20-year concession contract to design, build, maintain and operate the Saint-Denis Aquatic Centre and the adjoining walkway. The Saint-Denis Aquatic Centre will notably host the Olympic water polo, diving and artistic swimming events in 2024. It will also be a site for numerous sporting practices such as climbing, paddle tennis and fitness.

Hummingbird

Hummingbird, is an investment vehicle bringing together Omnes and Patriarca Group, a development and construction group dedicated to the construction and the redevelopment of office buildings in a prime location in Lyon.

Ilos Projects

Ilos Projects is a pan-European solar IPP based in Germany. Ilos Projects is developing and building a significant pipeline in Ireland, the UK, Italy, Greece, the Netherlands, Spain and Germany.

Power Capital Renewable Energy

Power Capital is the leading IPP in Irelans. The company has developed an amibitous solar PV portfolio and has signed power purchase agreements (PPAs) with leading technology companies. Power Capital recently expanded into the US market, through the acquisition of a local developer, where it ambitions to develop a solar PV portfolio as well.

Prosomnes

Prosomnes is a joint venture between Omnes and the Iberian PV developer Prosolia, a major operator in the solar energy sector in the Iberian Peninsula. Prosomnes is developing ground-mounted solar projects in Portugal, Spain, France and Italy.

NRG2all

NRG2All is a solar project developer in the Netherlands with a portfolio of projects at various stages of development.

Own Security

OWN is a major French player in cybersecurity, providing tailor-made, informed and adapted support thanks to its DNA of passionate and committed experts. OWN is a pure player in cybersecurity, combining in-depth knowledge of the challenges facing organizations with ongoing awareness of the threats they face. They advise and contribute to the cyber defense efforts of organizations of all sizes and in all sectors, inform and alert when risk is imminent through remediation and cybersecurity improvement actions.

At a time when most security players are taking a process-oriented approach, OWN has historically opted for a risk-based approach, i.e. understanding the threat in all its technical, methodological and cultural dimensions. This knowledge-based mastery is then articulated around the three fundamental components of our services: operate, warn, neutralize. The integration and updating of contextualized threat intelligence, from strategic thinking to the coupling of all the operational processes involved in their work and interventions, enables them to focus on the issues facing our customers’ businesses in the face of threats that we sometimes identify and anticipate, in order to make the right decisions and to provide and guarantee the relevance of appropriate technical solutions.

Anaqua

Anaqua is a provider of intellectual property management software targeting companies and law firms with large intellectual property portfolios. Founded in 2004, Anaqua offers integrated solutions and data analytics tools, enabling informed decision making to create successful intellectual property strategies.

Nemera

Nemera is a French enterprise, and a world leader in the design, development and manufacturing of drug delivery devices for the pharmaceutical, biotechnology and generic industries. The company specializes in 5 key delivery routes: parenteral, inhalation, ENT, dermal and transdermal, and ophthalmic.

Phoenix International

Phoenix International is the European leader in the aluminum extrusion sector. The company serves an extensive portfolio of extruders working in a broad range of applications across building, industrial (mechanical, pneumatic and electronic) and transport sec

Proxiserve

Proxiserve is a leading French utility group that provides energy services and submeters. Proxiserve offers, under long-term contractors, installation, maintenance and metering services for heating installations and water distribution in co-ownership and shared accommodation buildings in France.

Ekom Invest

Omnes and the Banque des Territoires have signed a strategic partnership with the Eklo hotel group. The latter offers an innovative hotel concept: good value, environmentally friendly and cosy, part way between a hotel and a youth hostel. This partnership was established via the creation of the real estate developer EKOM INVEST, set up to finance the design and construction of hotels operated by Eklo and with a high energy and environmental performance.

Omniprom

Omniprom is an investment vehicle bringing together Omnes, Promoval – a real estate developer, and Crédit Agricole Centre-est, via its subsidiary La Compagnie Foncière Lyonnaise. The purpose of this holding company is the acquisition of office buildings in prime location in Lyon and then their refurbishment into buildings with high energy and environmental performance.

Better Energy

Better Energy is a leading Nordic solar PV energy producer developing a portfolio in Denmark, Poland, Sweden and Finland. The enterprise plays a pioneering role in the development of non-subsidised solar projects.

UNITe

UNITe is one of the leading French IPPs of low-carbon, local, sustainable, and competitive electricity, with more than 60 production sites, of hydroelectric, wind, and photovoltaic.

SOLVIONIC

Founded in 2003 and based in Toulouse, Solvionic produces high-purity ionic liquids, used in new generation batteries, making them more reliable, more powerful and longer lasting.

AgomAb Therapeutics

Loss of tissue functionality or organ failure is often a result of inflammatory, metabolic, and fibrotic processes which can occur in a variety of difficult-to-treat diseases. AgomAb aims to resolve these processes by modulating specific regenerative pathways in the target tissue or throughout the body, ultimately leading to a structural repair of tissue and the restoration of organ function.

Therapixel

Founded in in 2013, by two former National Institute for Research in Digital Science and Technology (INRIA) researchers, Therapixel is a world leader in artificial intelligence applied to medical imaging. Winner of the “Digital Mammography DREAM Challenge” in 2017, Therapixel develops AI-based technology designed to help radiologists to detect breast cancer via mammograms.

Sentryo

Sentryo helps organizations embrace the promises of Industry 4.0 innovations by keeping their industrial operations safe from cyber-attacks. Sentryo’s ICS CyberVision award winning platform gives control engineers comprehensive visibility on their industrial control systems, detects anomalies and accelerates response to cybersecurity incidents keeping them ahead of cyber threats.

Asmodée

Asmodée is a publisher and distributor of board games and collectable trading cards. Founded in 1986, Asmodée is mainly present in three market segments: board games, collectable trading cards (particularly Pokémon) and the development of mobile app games based on original creations by Asmodée.

Mater Private

Mater Private is a private hospital group in Ireland. Mater Private operates 2 hospitals, 2 specialized advanced cancer centers and 7 clinics. The group employs 1,700 people, including 300 doctors.

Promach

Promach is a manufacturer, installer and maintainer of packaging machinery for production lines serving the agri-food, pharmaceutical and consumer goods industries. Founded in 1998 and based in Covington, Kentucky, the company operates around 50 manufacturing facilities and twenty offices worldwide.

Refresco

Refresco is the world’s largest independent bottler of soft drinks for retail (co-packing) and distribution brands. Founded in 1999, the company produces a full range of beverages including fruit juices, waters, teas and energy drinks.

Skill&You

Skill&You is a provider of online training services across three main areas: preparation for national education diplomas (vocational training), preparation for civil service recruitment exams, and professional development training. The company operates 14 online vocational training centers in France, Spain and French-speaking Africa.

CPO Immobilier

CPO Immobilier is a joint venture between Omnes and the event operator Culture et Patrimoine. This partnership has led to the refurbishment of an emblematic and historical asset, the Hangar Y in Meudon, which the Ministry of Culture has entrusted the asset's refurbishment and operation to CPO Immobilier. The building has a metal structure which was used for the pavilions of the 1878 World Fair, and served as a shelter for the first airships launched in France.

Grand Nancy Thermal

Omnes, Bouygues Bâtiment Ile-de-France and Valvital signed, alongside the Greater Nancy authority, a 30-year concession contract to design, build, finance, maintain and operate Grand Nancy Thermal, a thermal, aquatic and well-being centre. The project aimed to refurbish an existing site composed of the emblematic round swimming pool in the town of Nancy, outdoor pools and an indoor Olympic pool, and to increase its size to host a thermal centre, a sports & leisure aquatic centre, a well-being & spa centre and a hotel resort.

Green Campus

Green Campus was founded by Omnes, L’Auxiliaire, Foncière Magellan and Patriarca Group to redevelop the Moulin à Vent business park. Three areas of redevelopment have been implemented: (i) the improvement of the energy performance of existing buildings, (ii) the implementation of new services and (iii) the development of new buildings. Green Campus holds approx. 30 assets and around 40, 000 m² in operation and development.

Repower Renewable

Repower Renewable is an Italian company that holds a portfolio of wind, solar and hydro assets. Its pipeline of projects are at different stages of operation and development. The company is a strategic partnership between Capenergie 3 and Repower, a Swiss utility that is one of the key industrial players in the renewable energy sector in Europe.

Illmatar

Ilmatar Energy is a leading IPP in the Nordic markets, developing a portfolio of onshore wind and ready-to-build solar PV projects at various stages of development in Finland and Sweden. Ilmatar Energy is also one of the first operators in Finland to have secured PPAs with leading technology companies.

Notus Energy

Notus Energy France is a joint-venture between Capenergie 3 and the German group Notus. Its business activity is the development, acquisition, construction and operation of photovoltaic and wind projects in France. Notus is one of the leading independent renewable energy developers in Germany.

Vsora

VSORA is a European leader in ultra-high-performance AI inference silicon solutions. Founded in 2015 and headquartered in France, the company enables next-generation AI workloads in data centers, autonomous systems, and industrial robotics. VSORA’s global presence includes offices in Japan, Korea, Singapore, and Taiwan.

The VSORA Jotunn8 is a fully European-designed AI inference accelerator that brings the EU to the forefront of global AI performance. Delivering 3,200 Tflops dense fp8 compute power per chip, it matches the latest accelerators from global incumbents while offering close-to-theoretical efficiency, significantly lower latency, and dramatically reduced power consumption.

Audiotonix

Audiotonix is a designer, engineer and manufacturer of audio mixing consoles for live events, recording studios and broadcast. Its brands provide live sound solutions for concerts, television, shows and major international events. Founded in 2014 through the merger of DiGiCo, Calrec and Allen & Heath, the company operates in more than 90 countries through a network of over 150 distributors.

DomusVi

Etpomnia

Omnes Capital and ETPO Group set up ETPOMNIA to develop high-performance environmental tertiary property projects in the area of Nantes.

Foncière des Lunes

La Foncière des Lunes, set up by Omnes and Groupe Evolution, develops, owns, and operates the ecosystem Darwin, an iconic urban renovation project in Bordeaux in former military barracks. La Foncière des Lunes currently owns c. 20 000 sqm of multi-purpose surfaces, in both operating and development phases.

AutoForm

AutoForm is the number one supplier of sheet metal forming feasibility software solutions for the automotive and aircraft industries, and in the field of medical equipment and home appliances. AutoForm’s software solutions are designed for validating the feasibility of parts, simulating the manufacturing process and refining the design of tools used.

Sitecore

Sitecore is a supplier of unmatched digital experience software that combines customer content, commerce and knowledge. The company enables clients to boost their sales performance thanks to adapted content on all channels, which enhances -end-customer satisfaction and loyalty.

seniorAdom

Founded in November 2012, SeniorAdom offers new remote assistance technology. SeniorAdom’s next-generation technology automatically detects falls and sudden illness using a smart system of detectors (no cameras) connected to a central device. This central device is easy to install and use. It can simply be plugged into a power socket (no need for an internet connection because it has an embedded GSM mobile phone card). No special training is required.

In addition to falls and sudden illness, SeniorAdom’s solution can also report any unusual patterns in the life of a dependent person by sending a text or email to their carer. Each carer has a personalised and secure space from which they can monitor the well-being of the person living in their own home. SeniorAdom has genuinely disrupted the remote assistance space, which had barely advanced in 35 years. It provides comfort and peace of mind to both carers and service users.

Delete Group

Delete Group is a provider of environmental services for the industrial, construction, real estate and public service sectors that require specialized expertise and equipment. The group operates across three main business areas: industrial cleaning, demolition, and recycling services.

Eole Infrastructure 2

Eole Infrastructure 2 is a holding of renewable energy projects in France, focusing on solar and wind. The company’s ambition is to constitute a solar and wind power projects portfolio in France. Eole Infrastructure benefits from strong industrial partners with a proven track record.

Elettromnes

Elettromnes is an Italian infrastructure holding established to accelerate the growth of Elettrostudio Energia, a historical investment of the Capenergie funds in Italy. The company has acquired a minority stake in a diversified renewable energy portfolio.

Froneri

Froneri is a global ice-cream manufacturer created in 2016 through the joint venture between Nestlé Grand Froid and R&R to strengthen their leadership in the ice-cream market. The company is the second-largest producer of ice-cream in Europe, the third-largest worldwide, and the leading global manufacturer for major distributor brands.

Société Géothermale de Val d’Europe (Villages Nature)

Société Géothermale de Val d’Europe is a company designing, constructing and operating geothermal production systems and heat networks. The company is located on the site of the touristic resort "Villages Nature" in Marne-la-Vallée, close to Paris. The project provides thermal energy to the resort, and supplies the residual heat to the neighboring "Disneyland" site.

Ameos Gruppe

The AMEOS group is one of the leading healthcare providers in German-speaking countries. Founded in 2020, the AMEOS group now possess more than 95 facilities (hospitals, polyclinics, follow-up and rehabilitation care) distributed over more than 50 sites.

Diam International

DIAM is a leading provider of merchandising solutions for cosmetic and luxury brands, specializing in the creation, production and installation of in-store displays. Founded in 1968 and managed by Michel Vaissaire since 2007, the group works with prestigious clients including Chanel, Clinique, Dior, Estée Lauder, Cartier, L’Oréal, Lancôme, Clarins, LVMH, Shiseido, Coty and P&G.

Moncler

Moncler is a specialist company that manufactures top of the range down jackets and ski clothing.

RAC

Royal Automobile Club (RAC) was the second-largest roadside assistance service and firth-ranking motor insurance provider in the United Kingdom in 2011. Founded in 1897, the company serves approximately 8 million clients in the country.

VUE Entertainment

Vue Entertainment is the third-ranking cinema chain operator in the United Kingdom. Vue Entertainment operates more than 280 sites (>2400 screens) in 10 countries.

Ikaros Solar

Ikaros Solar, based in Belgium, designs and installs turnkey solar plants on the rooftops of industrial and commercial buildings. The company is a leader on the market for major photovoltaic rooftop installations, and has delivered installations to Ikea, Philips, Carrefour and Johnson & Johnson.

Ikaros Solar Park 1

Ikaros Solar Park 1 is a holding company set up to invest in photovoltaic power plants built by Ikaros Solar, a Belgian company that develops turnkey solar photovoltaic power plants. Ikaros Solar Park 1 owns the Kluizen facility, one of the largest ground-based photovoltaic facilities in Belgium.

Neoen

Qualtera

Thanks to its big data platform (Silicon Dash), Qualtera provides electronic component manufacturers with business intelligence solutions improving the quality and returns generated by production chains.

Founded in 2010 by a team of serial entrepreneurs, the company is headquartered in Montpellier and has in the region of 20 employees.

Elettrostudio Energia

Located in Venice-Mestre, Elettrostudio Energia is an Italian IPP. The company’s activities cover the entire renewable value chain, from project development and financing, construction, operation and maintenance, to asset and energy management service. Elettrostudio Energia holds a portfolio in wind, solar, biomass and hydro projects.

Bizanga

Bizanga, a specialist in email management, sold its IMP (Intelligent Message Processor) email traffic management platform to US partner Cloudmark. Bizanga retains its storage business and has changed its name to Bizanga Store.

Miyowa

Founded in April 2003 by Pascal Lorne and François Colon, Miyowa is a technology enabler delivering solutions to mobile phone operators looking to add community-based services to their offering.

Numéricable

Numéricable was the leading TV cable operator and cable internet provider in Metropolitan France, prior to the merger in 2014 with SFR to form the group Altice France.

Methaneo

Urbasolar

Solar Energies

Solar Energies is a holding company set up to finance photovoltaic plants. It is the first investment made by Aérowatt Participations, set up by Omnes and Aérowatt, dedicated to making investments in renewable energy projects.

Valorem

Valorem is a pioneer in the French wind industry. The company's portfolio consists of high quality and diversified projects. Valorem controls the entire development cycle of green power generation, from prospecting and design through to project management and full operation. The group has international exposure and exported its expertise to Africa, Eastern and Northern Europe and the Caribbean.

Société des monts de Lacaune

Velcan Energy

Velcan Energy operates as an IPP, focusing on the hydro sector. Velcan Energy develops, constructs and exploits hydropower plants. The company is present in emerging countries such as India, Brazil, Laos and Indonesia and is managing a global portfolio of assets. Velcan Holdings is listed on the Paris Euronext Growth Stock Market.

SEVE / La compagnie du vent

Novaled

German company Novaled has developed a new structure and new doping materials curbing power consumption and extending the life of organic light-emitting diodes (OLED). At the time of the sale, the company owned more than 400 patents.

DenyAll

DenyAll was a French cybersecurity company specialized in application-layer security, with a strong focus on protecting web applications and web services. Its core offering included web application firewall (WAF) technology and related solutions to secure and control access to online applications, helping organizations reduce exposure to attacks targeting web and API layers. Following its acquisition by Germany’s Rohde & Schwarz in 2017, DenyAll’s technologies were integrated into the Rohde & Schwarz Cybersecurity portfolio, with several products continuing under “R&S DenyAll” branding.

Emulation and Verification Engineering SA (EVE)

Emulation and Verification Engineering SA was founded in April 2002 by a team of specialists from the EDA, predominantly from Meta Systems (Mentor Graphics group). EVE has devised a revolutionary solution for the verification of integrated circuits, which can emulate code using FPGA standards. This platform helps to shorten design times for the complex integrated circuits frequently used in communication devices and more generally in all electronic devices.

3D Plus

3D Plus SA is a Thalès spin-off. The 3D interconnection technologies developed by the company enable stacking of hybrid components (memory, microprocessors, etc.) in embedded electronic systems, to save space, improve performance and enhance system robustness

Tronic’s Micro Systems

Tronics Micro Systems is a spin-off from CEA Leti (French atomic energy commission’s electronics and information technology facility). The company designs, manufactures and markets high value-added MEMS (micro-electro-mechanical systems) solutions for specific applications in the medical sector, telecoms, aerospace/defence and oil exploration.

The company has a presence in France, the United States and China.

Amalfi

Amalfi is a major private label food supplier born from the merger of La Doria and Winland Foods. This combined company is a leader in both Europe and the US, particularly strong in pasta, sauces, condiments, and tomato products. By joining forces, La Doria and Winland Foods leverage their individual strengths to become a top contender in the private label food market.

Ethypharm

With around 20 products distributed in 30 countries, Ethypharm is a pharmaceutical laboratory specializing in the treatment of central nervous system indications, notably chronic pain and opioid dependence, as well as a range of high-quality injectable medicines for critical care situations.

Eurofiber

Eurofibrer is the biggest independent supplier of permanent telecom infrastructures dedicated to business clients (B2B) in the Netherlands and Belgium. Its fiber optic network is spanning across more than 37,000 km and connecting more than 12,000 single sites, Eurofiber is supplier of telecom infrastructures that are critical for the Dutch and Belgian economies, connecting public service networks, mobile networks, business center and public bodies.

Fine Sounds

The Fine Sounds group is a leader on the high-end audio equipment market. It gained its position via the successive acquisition of prestigious brands. It holds several of the most revered, high-end audio equipment brands: Sonus Faber, known for its finely handcrafted loud speakers, McIntosh for its amplifiers, Audio research for its valve amplifiers and Wadia for its CD and DAC readers. It is an international group, with production sites in Italy and the United States and a distribution network in 67 countries.

Intersec

Intersec designs innovative software enabling companies to leverage their Big Data. Our disruptive technology crunches and consolidates huge amounts of data coming from heterogeneous network equipment and IT, and turns them into actionable insights in real-time. Applications range from Customer Base Management, mass-scale Location-Based Services, Fraud Management and Business Analytics.

Scality

Highly effective open infrastructure solution for large-scale unstructured data storage

Scality has developed RING distributed storage software, which provides a massively scalable solution for handling very large data volumes. RING is a patented and tested solution that has been deployed right around the world.